economy

The expansion of the Trans Mountain Pipeline will affect Canada’s economy. For instance, the increase of jobs in the infrastructure and construction industry will increase by 15,000 jobs. As of fall 2016, the number of employees in British Columbia’s construction sector is 210,000 and will increase by 6.66%. This project will boost Canada’s gross domestic product (GDP) by $19.1 billion during construction and operations over the next 20 years.

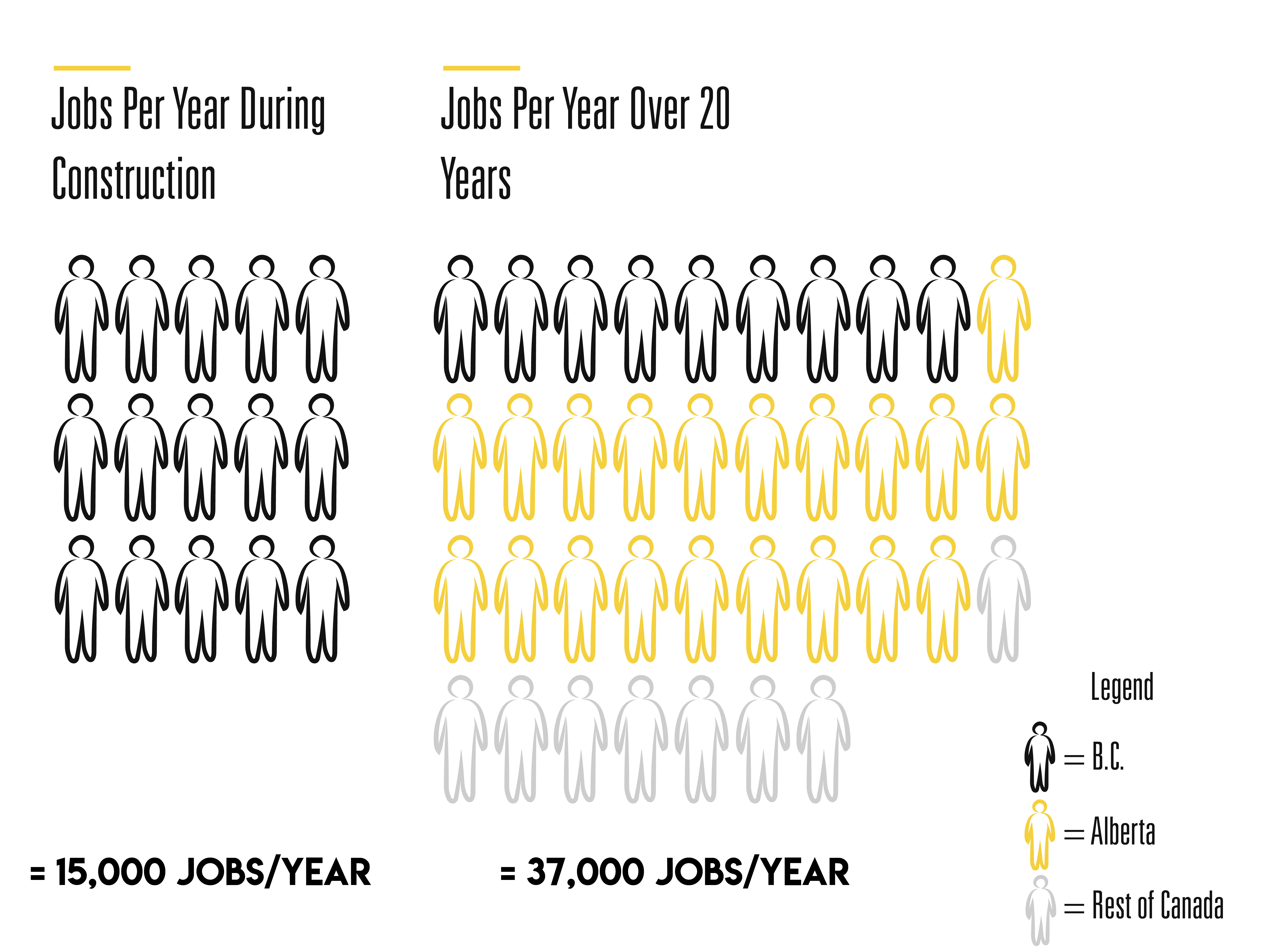

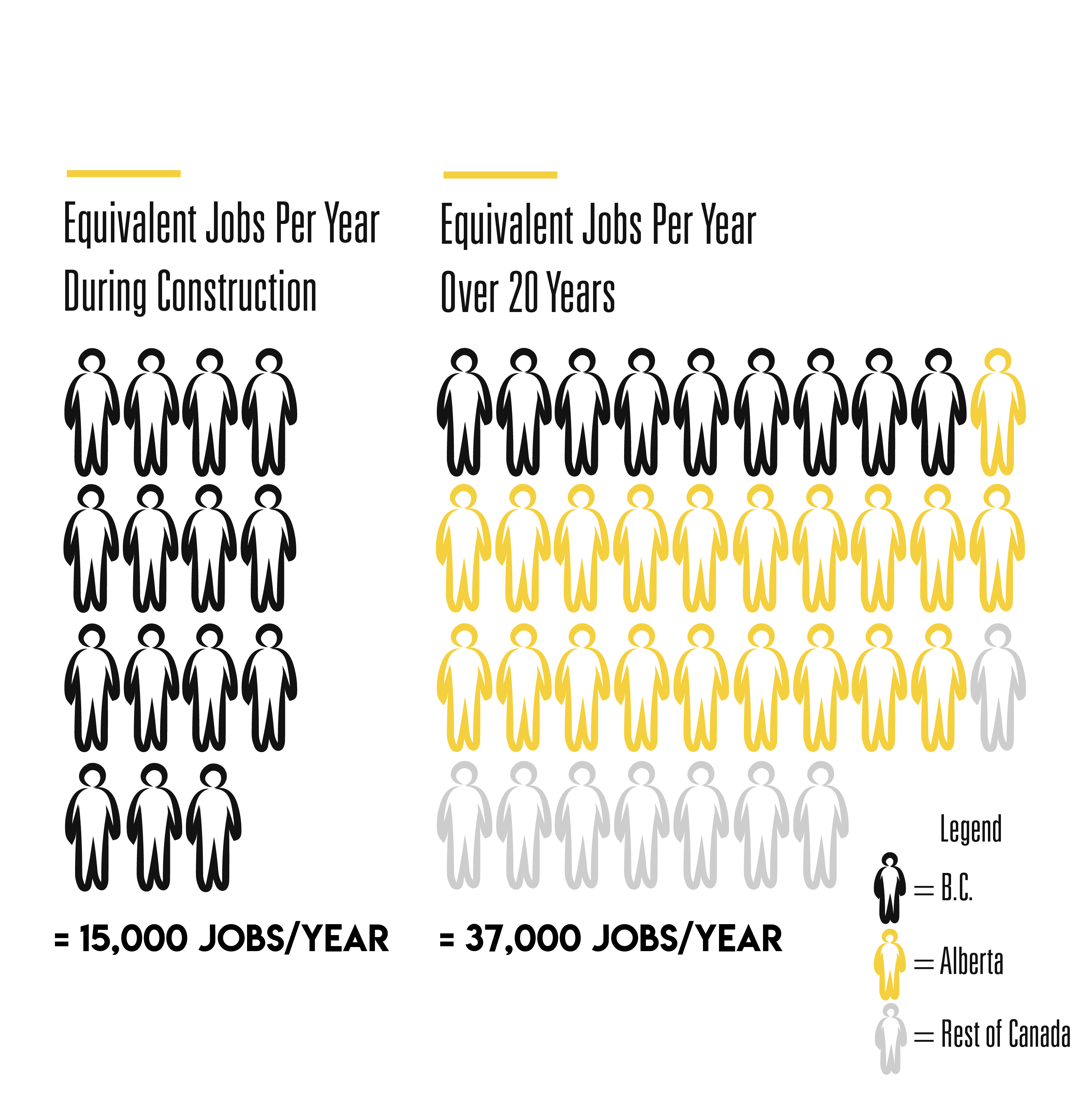

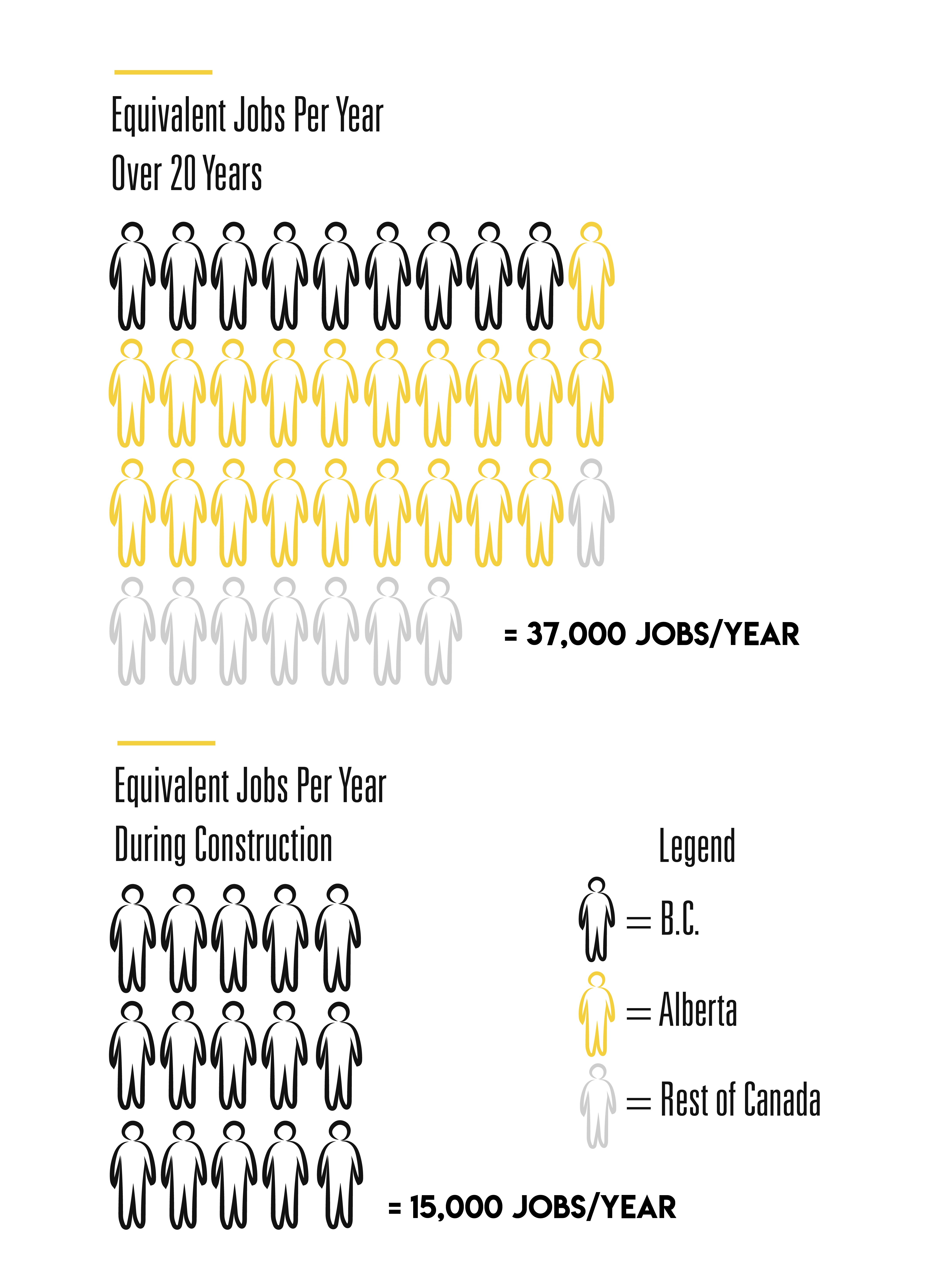

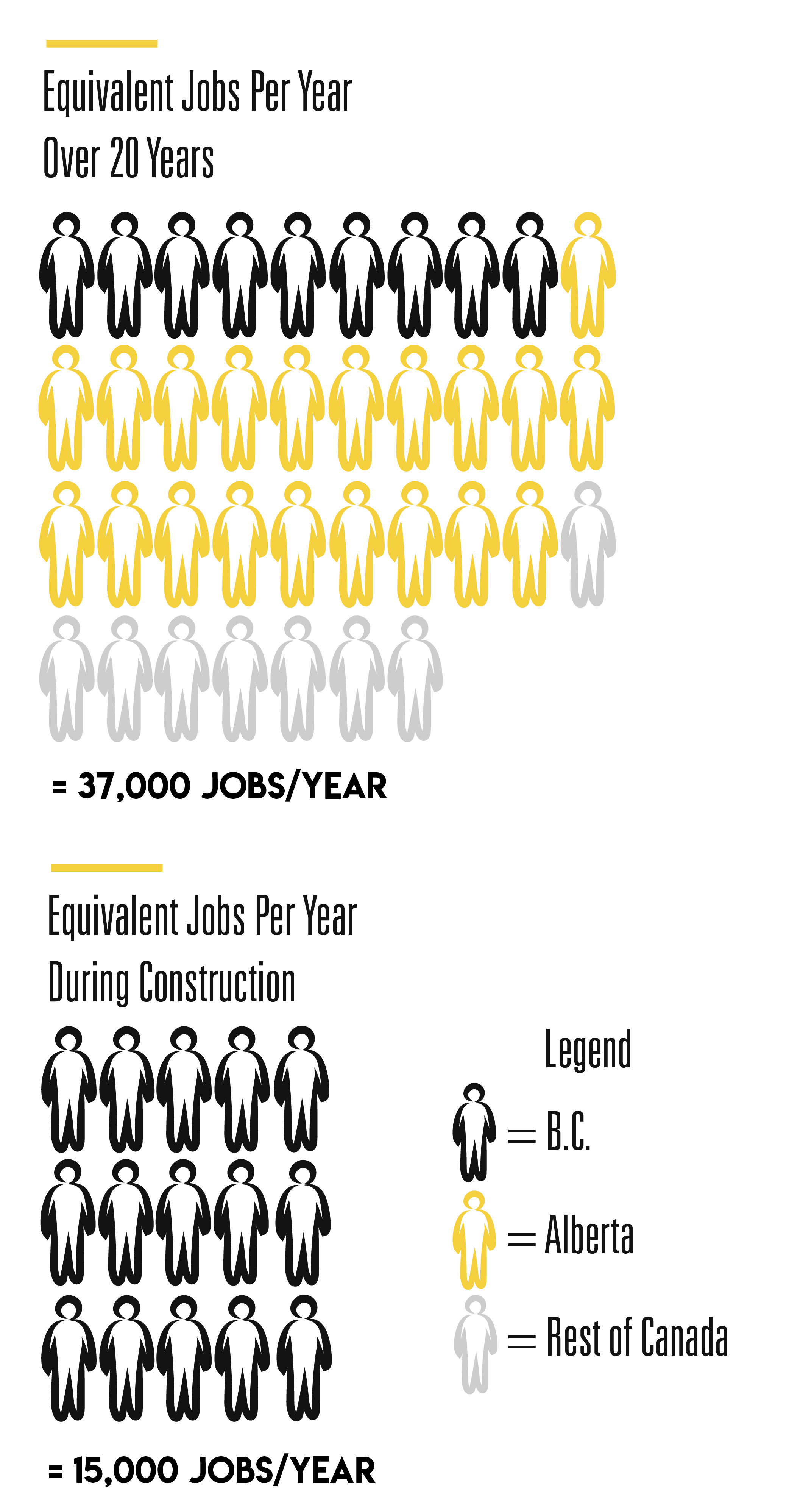

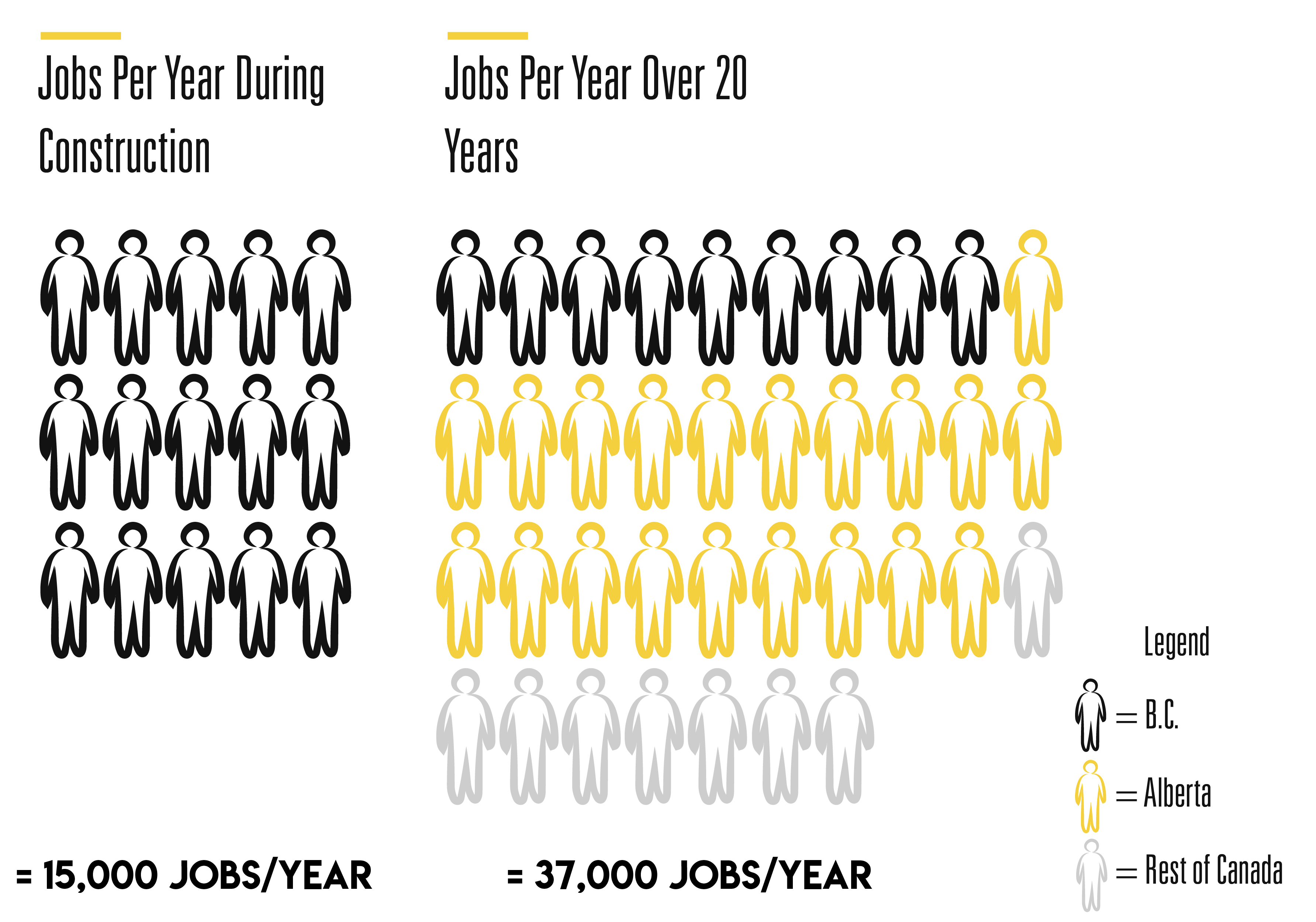

job increase

During the expansion it will bring about 15,000 jobs from late 2017 to late 2019. For the following 20 years the Trans Mountain Pipeline will have 9,450 jobs in British Columbia, 22,050 jobs in Alberta, and 8,550 person-years of employment to the rest of Canada (Trans Mountain, 2017). According to reports from fall of 2016, there were 210,000 people working in the construction sector in British Columbia. So the 15,000 jobs offered by this project will increase the workforce by 6.66% (British Columbia Construction Association, 2016).

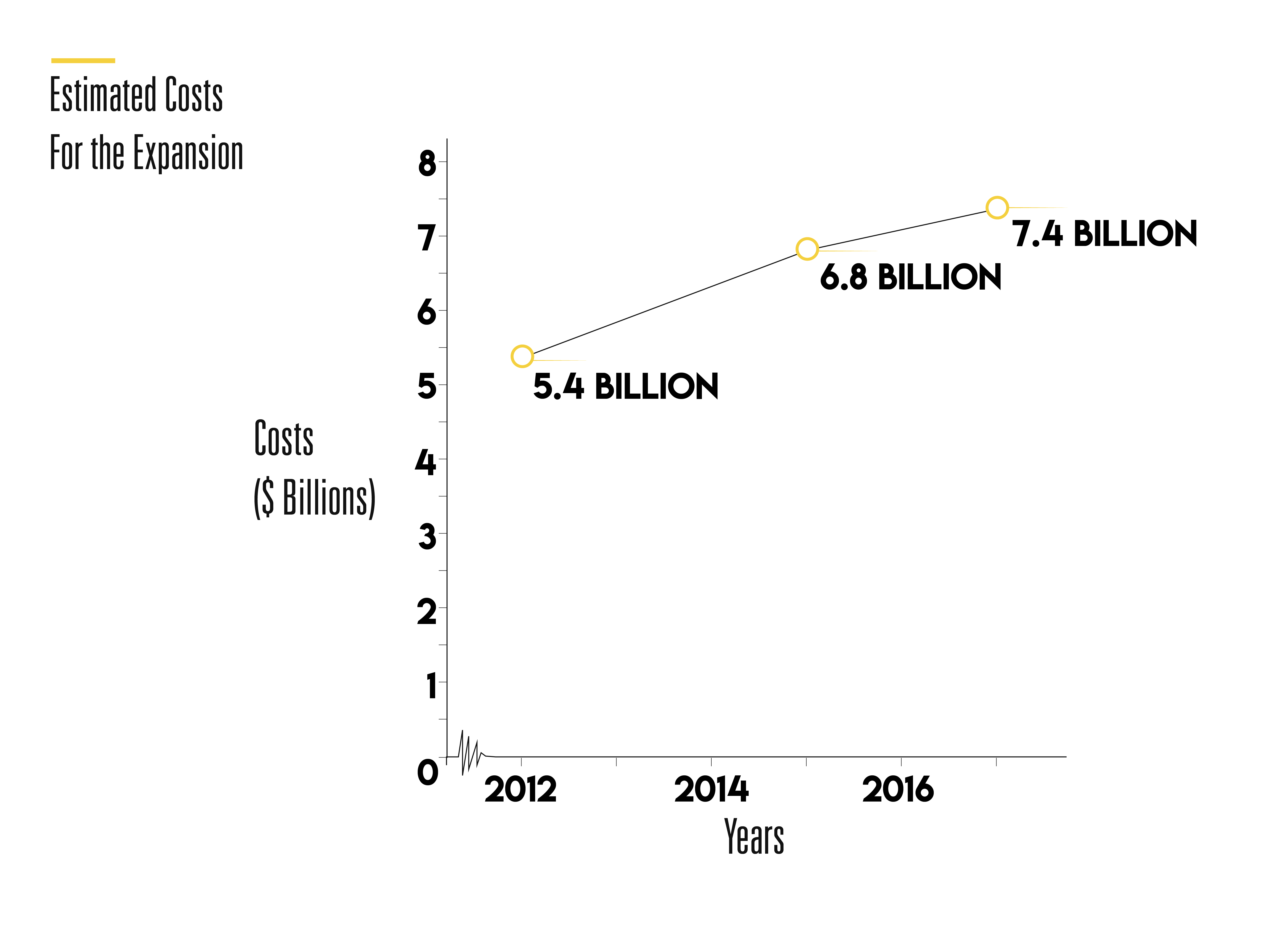

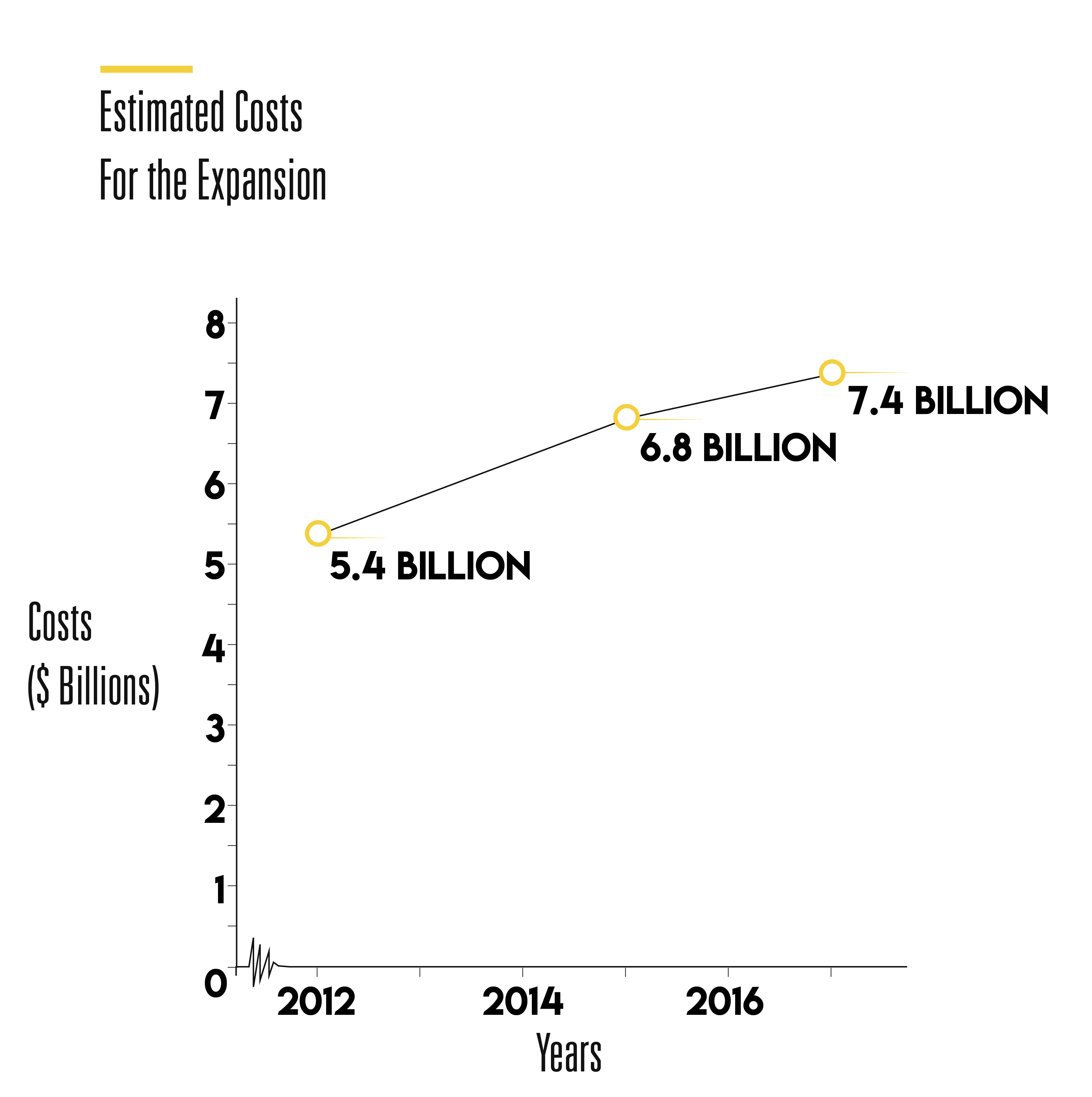

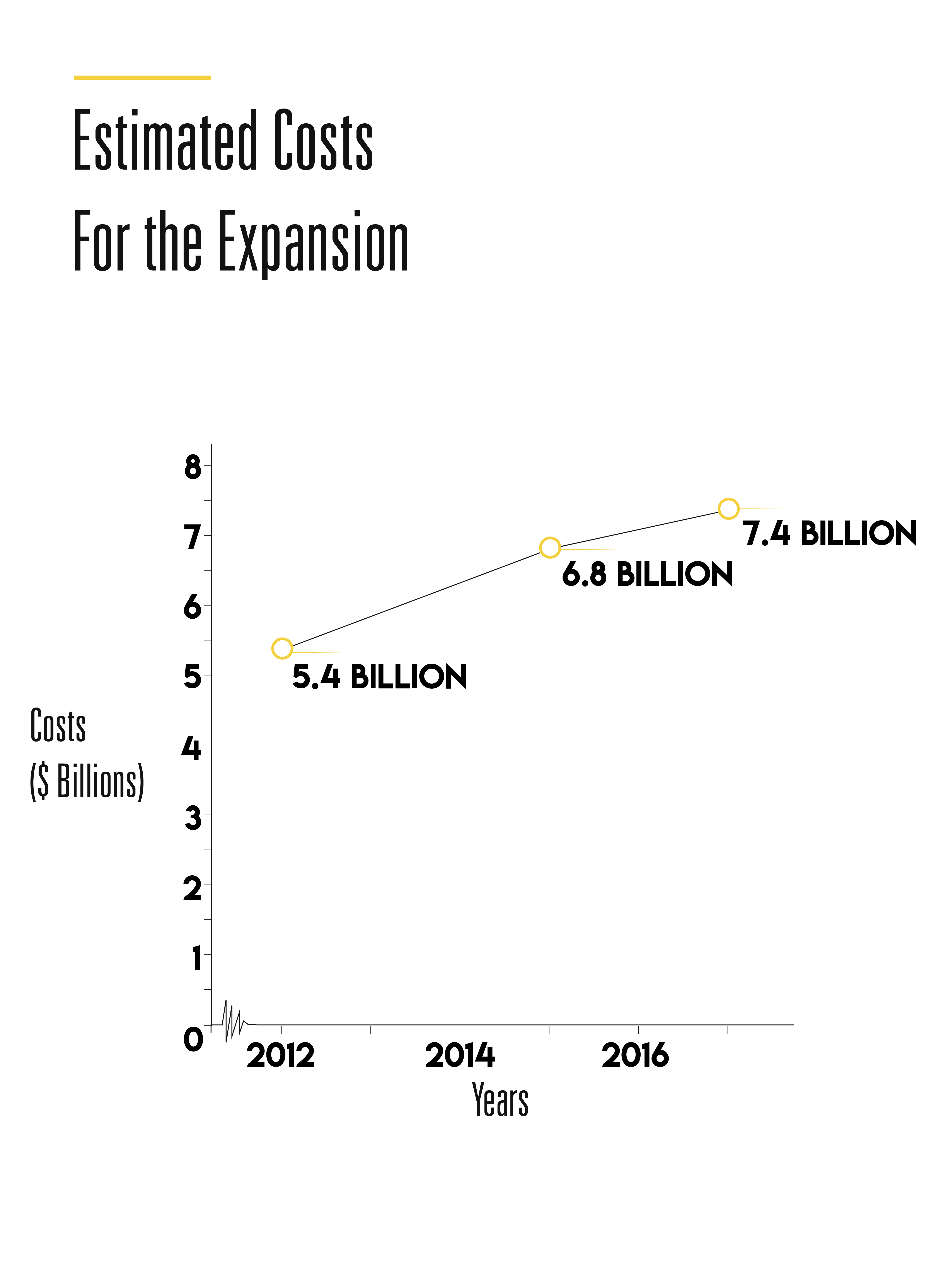

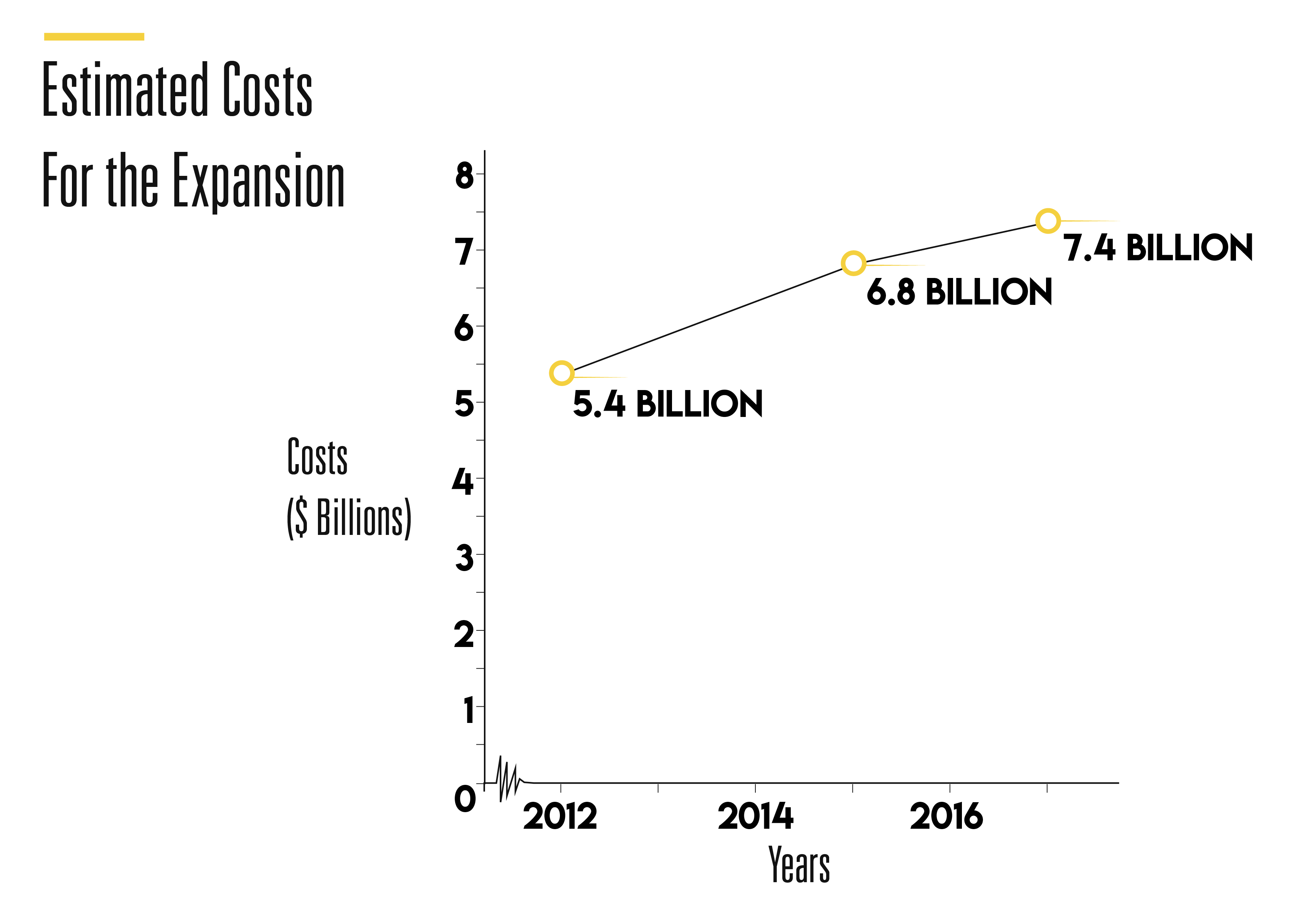

costs

In 2012, Kinder Morgan’s estimated cost of the Trans Mountain pipeline project was $5.4 billion. In 2015, it was increased to to $6.8 billion due to foreign-exchange swings, changes and delays to the project, increased compliance costs including the National Energy Board’s 157 conditions (Trans Mountain Expansion Project, 2016), thicker pipe walls, additional drilled water crossings, and the Burnaby Mountain tunnel. In 2017, Kinder Morgan escalated the cost of the pipeline expansion again to $7.8 billion (Vancouver Sun, 2017).

economic benefits

With the federal government’s approval for the Trans Mountain Expansion Project, Canada’s overall gross domestic product is estimated to increase by $19.1 billion during the construction and operations over the next 20 years (Kelowna Now, 2017). The gross domestic product (GDP) is the total value of all goods and services produced within a given period by a national economy through domestic factors of production. To put into comparison, in 2016, Canada’s GDP was $1.53 trillion USD and global GDP was approximately $75.64 trillion (Statistics Time, 2016).

British Columbia is estimating to earn over $2.2 billion in provincial tax revenue and another $512 million through property taxes during construction and operations over the next 20 years. Kinder Morgan will contribute about $1.2 billion on marine safety over 20 years, spend $20 million on greenhouse gas offsets, spend $382 million on First Nations mutual-benefits agreements, and spend $11.2 million on community-benefit deals (Vancouver Sun, 2016).